Struggling with downtime from faulty coil packaging equipment? The wrong vendor choice can derail production for weeks. Hidden costs from poor reliability and patchy support quietly bleed your budget dry. This checklist solves that pain – revealing how to systematically vet suppliers for maximum uptime and ROI.

Selecting a reliable coil packing line vendor requires evaluating technical capabilities, manufacturing transparency, and post-purchase support. Prioritize suppliers with: documented quality certifications (ISO 9001), verifiable client references in your industry, modular equipment designs for future upgrades, and 24/7 technical assistance guarantees. Always demand performance clauses in contracts – binding uptime commitments separate market leaders from competitors.

Making the right vendor choice impacts your bottom line for years. Beyond specifications, true reliability emerges from how suppliers handle crises and sustain partnerships. Let’s break down the critical evaluation phases.

Defining Your Technical and Operational Requirements

Ever ordered equipment only to discover mismatched specs during installation? Vague requirements guarantee costly rework. Clearly defining needs upfront prevents 63% of post-purchase disputes (Packaging Machinery Manufacturers Institute). Start by mapping production variables before talking to suppliers.

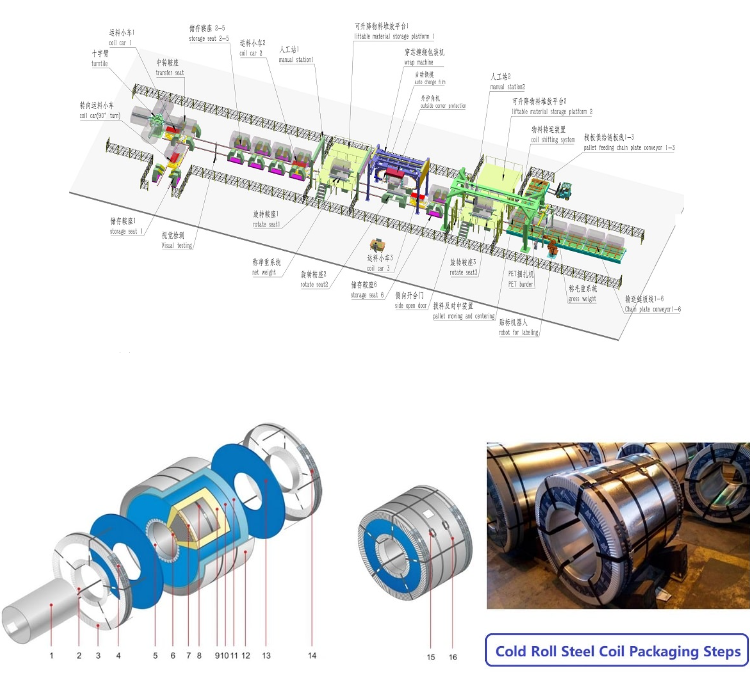

Your requirements document must specify: coil dimensions/weights, target throughput (coils/hour), integration needs with existing lines, automation level (manual vs. robotic), and future scalability. Include mandatory certifications like CE or OSHA compliance. This baseline filters unsuitable vendors immediately and aligns proposals with actual operational needs.

Translating Production Needs into Technical Specs

Start with material analysis. Steel coils demand different strapping tension than softer aluminum or copper – requiring adjustable force controls. Document maximum/minimum coil weights; undersized conveyors cause jams, while oversized equipment wastes energy. Throughput calculations should account for changeover times; a vendor promising 30 coils/hour may assume zero format adjustments.

Environmental factors drastically impact design. Coastal facilities need stainless steel components to resist salt corrosion, while arctic sites require hydraulic fluid rated for -40°C. Dusty mills? Enclosed electrical cabinets with positive air pressure are non-negotiable. I’ve seen plants omit these details, resulting in 6-month retrofits.

Integration complexity is underestimated. Will the packing line receive coils directly from a slitter? Synchronizing speeds prevents pile-ups. For brownfield sites, measure floor space precisely – including safety perimeter clearance. One automotive supplier ignored crane height limits, causing a $200k structural modification.

Scalability separates tactical buys from strategic partnerships. Can the system handle 25% volume increases? Modular designs allowing additional strapping heads or palletizers extend equipment lifespan. Demand CAD layouts showing upgrade paths.

| Critical Requirement Checklist Table: | Parameter | Baseline Data Needed | Consequence of Omission |

|---|---|---|---|

| Max Coil Weight | Weight + Diameter (e.g., 25T Ø1800mm) | Conveyor/roller deformation | |

| Throughput Peaks | Coils/hour (including changeovers) | Bottlenecks during high-demand periods | |

| Ambient Conditions | Temperature range, humidity, particulates | Premature corrosion/electrical failures | |

| Future Expansion Scope | Planned capacity increases (next 5 years) | Incompatible upgrades requiring full replacement | |

| Safety Certifications | Required standards (e.g., ISO 13849 PLd) | Regulatory shutdowns/fines |

Assessing Manufacturing Quality and Reliability

A polished sales pitch crumbles if equipment fails in month two. True reliability lives on the factory floor – not in brochures. How do you verify build quality before signing?

Verify reliability through: unannounced factory audits checking welding/assembly standards, component traceability (demand mill certificates for steel), and testing protocols. Critical metrics include meantime-between-failures (MTBF) data from existing clients and defect rates during FAT (Factory Acceptance Tests). Suppliers refusing transparency on these points pose unacceptable operational risks.

Forensic Evaluation of Build Integrity

Request video documentation of critical assemblies – motor-gearbox alignment or hydraulic manifold construction. Reputable vendors provide this willingly. During audits, inspect weld seams under UV light; inconsistent beads indicate poor training. Electrical panels should follow IP54 standards minimum, with labeled, loomed cables. I once found a "premium" supplier using consumer-grade contactors – a $10 part causing $80k/hour downtime.

Component traceability is non-negotiable. Demand certificates for:

- Steel used in frames (e.g., S355JR tensile strength)

- Cylinder manufacturers (Parker vs. unknown clones)

- PLC brands (Siemens S7 series preferred)

Cross-reference serial numbers during FAT. One mill discovered counterfeit bearings by verifying SKF numbers directly with the manufacturer.

Testing rigor predicts field performance. Beyond basic functionality checks, insist on:

- 48-hour continuous run tests at 110% design speed

- Vibration analysis on drive systems

- Emergency stop response time measurements (<0.5 seconds)

A European service center shared data showing suppliers skipping vibration tests had 3x more bearing failures in year one. Quantitative evidence beats promises.

Negotiating After-Sales Support Agreements

60% of packing line downtime stems from unresolved post-installation issues (PMMI 2023). Your contract’s service terms determine whether minor glitches become week-long stoppages.

Ironclad service agreements must include: 24/7 remote diagnostics access, guaranteed response times for critical failures (e.g., 2 hours remote/24 hours on-site), spare parts availability commitments (local stocking), and technician training programs. Penalty clauses for breaching SLA terms protect your operations. Documented escalation paths to senior management prevent support stalemates.

Structuring Service Contracts for Maximum Uptime

Standard warranties often exclude "wear parts" – a loophole covering 80% of failures. Redefine inclusions:

- Explicitly list covered components (strapping heads, sensors, PLCs)

- Cover labor for all Year 1 failures

- Mandate 5-year spare parts availability

Response time clauses need teeth. "Best effort" is meaningless. Demand:

- Level 1 (Total Line Stop): 2-hour remote diagnosis, 24-hour on-site

- Level 2 (Partial Downtime): 4-hour remote, 48-hour on-site

- Penalties: 1% of contract value/day for missed deadlines

Training determines self-sufficiency. Require:

- 40+ hours of hands-on maintenance training

- Troubleshooting simulators for operators

- Password-protected video libraries for quick fixes

Remote diagnostics are non-negotiable. Modern systems should transmit:

- Real-time torque/voltage graphs

- Error log histories

- Predictive maintenance alerts

| Service Agreement Benchmark Table: | Term | Industry Standard | Recommended Requirement |

|---|---|---|---|

| On-site Response | 72 hours (critical failure) | 24 hours (with penalties) | |

| Remote Support Hours | Business hours (M-F 9-5) | 24/7 with dedicated team | |

| Spare Parts Delivery | 5-10 business days | 48 hours (critical components) | |

| Technician Training | 8-hour basic operation | 40-hour certified maintenance | |

| Software Updates | Annual paid upgrades | Lifetime minor updates included |

Finalizing Your Vendor Selection

Create a weighted decision matrix scoring: technical compliance (30%), reliability evidence (25%), service terms (30%), and commercial terms (15%). Involve maintenance leads in demonstrations – their feedback identifies hidden operational flaws. Always conduct reference visits to existing clients; ask for unedited maintenance logs to verify performance claims.

The Step-by-Step Selection Protocol

Phase 1: Technical Screening (Eliminate 50% upfront)

- Audit requirement compliance matrices

- Reject vendors lacking industry-specific references

- Exclude those refusing factory audits

Phase 2: Operational Deep Dive

- Conduct FAT witness tests with your engineers

- Review 12 months of MTBF data from 3+ clients

- Simulate changeovers during demos (timed)

Phase 3: Commercial Negotiation

- Tie 20% payment to successful SAT (Site Acceptance Test)

- Negotiate consignment spares inventory

- Secure extended warranty discounts for multi-line deals

Phase 4: Partnership Validation

- Visit client sites unannounced (ask operators, not managers)

- Verify response time records with service departments

- Check training certification validity

The contract must include:

- Liquidated damages for missed performance guarantees

- Technology escrow agreements (for proprietary systems)

- Intellectual property protections for customizations

Post-award, conduct quarterly business reviews tracking:

- Actual vs. promised uptime

- Support ticket resolution rates

- Continuous improvement initiatives

Conclusion

Choosing a coil packing line vendor demands forensic scrutiny across technical capability, manufacturing integrity, and ironclad service commitments. By methodically applying this checklist – from requirement specification to contract penalties – you secure not just equipment, but production resilience. Remember: the cheapest bid often carries hidden costs in downtime and frustration. Prioritize vendors demonstrating transparent reliability data and treating Supplier Reliability as a core value, not a buzzword. Your selection today dictates operational stability for the next decade.

Leave a Reply

You must be logged in to post a comment.